Multi company Direct Debit Solution

You spoke - we listened. We have updated our most popular Direct Debit software for Sage 50c. We are now offering a multi company Direct Debit solution.

The…

Sage 50 v28 has arrived – upgrade now!

The next release of Sage 50 Cloud Accounts v28 is available now

Here are some of the new features and improvements that have us excited...

Remote…

Sage Payroll v24.3 is OUT NOW

The latest release of Sage Payroll v24.3 is available now to download and install

Sage Payroll makes it easier for you process your payroll by preventing…

Awaiting Sage 50cloud Accounts v28

The next release of Sage 50cloud Accounts v28 is coming soon.

Here are some of the new features and improvements that have us excited

Remote Data Access…

Microsoft

MicrosoftWindows 11 and Sage 50

Microsoft Windows 11 Introducing New Operating system

The next release of Microsoft Windows Operating System, Windows 11 was released on…

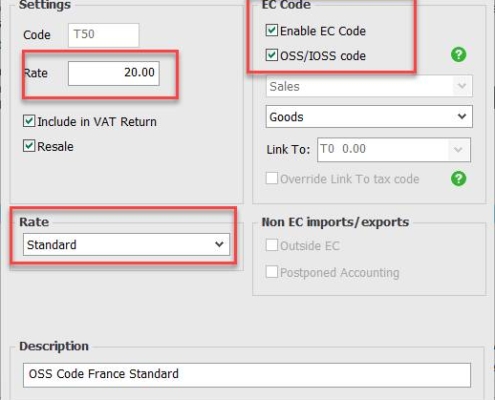

Import One Stop Shop (OSS/IOSS)

From the 1st July 2021 the Import One Stop Shop simplifies the reporting and paying of VAT when selling goods and services cross-border to final consumers…

Sage 50c Accounts v27.2 – upgrade now

Have you upgraded to Sage 50c accounts v27.2 yet? If not , you are missing out on several important new features.

VAT Improvements

Postponed accounting…

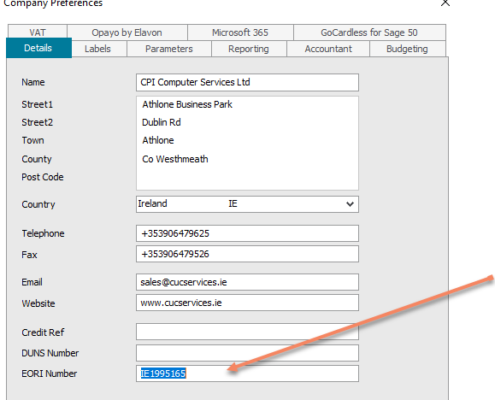

Post Brexit VAT – Get ready with Sage 50c Accounts

Sage 50c Accounts V27.1 and later versions are ready to deal with Post Brexit VAT. The latest version of Sage 50c caters for Postponed Vat and the…

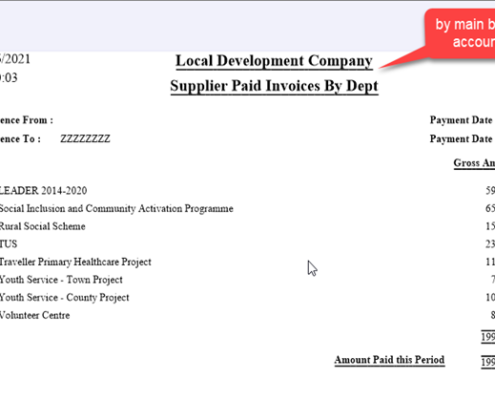

Reporting Solution for Local Development Companies

Reporting Solution for Local Development Companies using Sage50

The Local Development sector in Ireland is a vibrant sector where partnerships deliver…

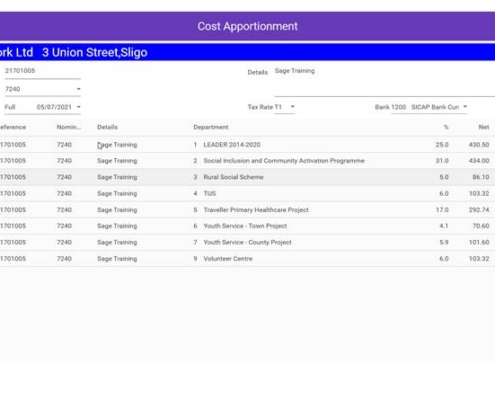

Apportionment Tool for Sage 50c- Apport50

Apportionment Tool for Sage 50c - Apport50

Are you tired of apportioning purchase invoices over numerous departments when inputting into Sage…