Hire Purchase Agreements and Leases

This knowledge base article seeks to unravel the mysteries of Hire Purchase agreements and Leases and how to account for them in Sage 50 accounts.

To account for the financing of an asset you need to take into account whether the asset is owned from the outset or is it a rental, if unsure of its nature talk to your accountant before setting up and accounting for it in Sage.

Rental

This is usually straightforward enough as the asset is never owned and there will be an annual schedule for Vat on the monthly repayments. A nominal code for Leases needs to be setup in the 7000’s or 8000’s as it is an expense and the monthly payment is entered with the Vat as a Sage Bank Payment.

Hire Purchases Agreement/Lease Purchase

We recommend the following procedure

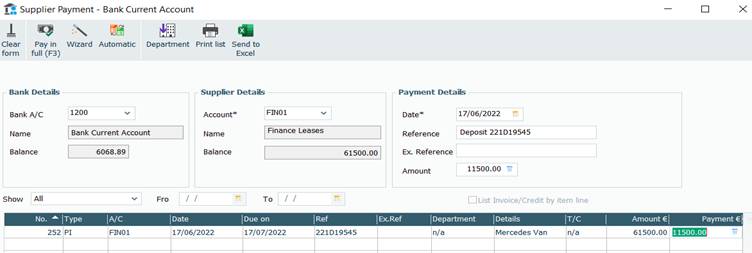

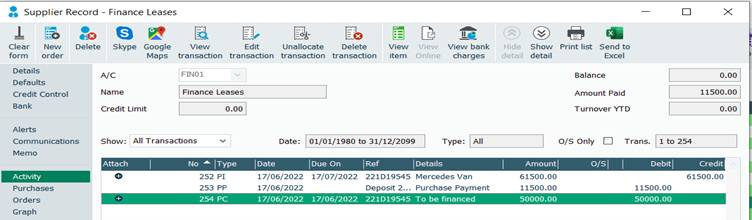

- Setup a Supplier Account for the purchase

- Enter a supplier invoice for the asset purchases in this case the Van ensuring that the nominal code is for the asset and vat code for 23% to record vat on purchase

- The balance is reduced by the deposit paid usually for the Vat Amount if not more

- This leaves a balance in this case 50,000 to be financed

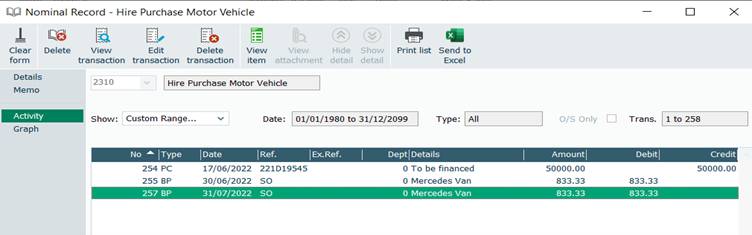

- A credit note is entered transferring the balance from the Supplier account to a nominal account 2300 for the Hire Purchase Agreement or lease and the tax code is T9. This represents the capital amount owing without the interest

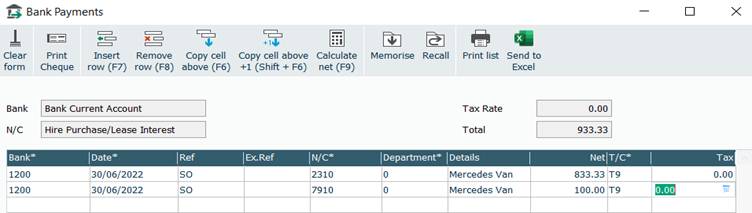

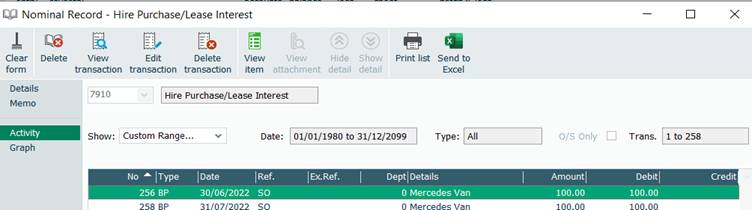

- The finance is for 50,000 and the interest is 6,000 this will entail splitting the monthly repayment in two over 60 repayments. 833.33 to reduce the capital of 50,000 and the interest goes to Hire Purchase Lease Interest of 100 euro

- The monthly payment being broken down as below

- The capital element is being reduced by the capital element of the repayment

- The interest part of the 933.33 repayment 100 is in the Hire Purchase Interest Nominal Code 7910