Hire Purchase Agreements and Leases

This knowledge base article seeks to unravel the mysteries of Hire Purchase agreements and Leases and how to account for them in Sage 50 accounts.

To…

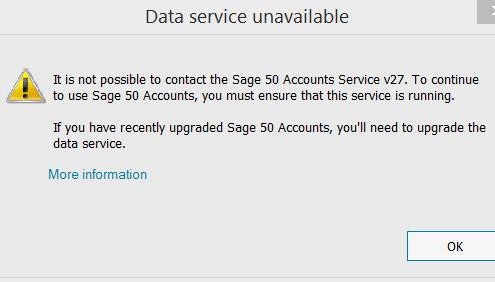

Sage Data Service

One of our most frequently asked questions is about the Sage Data service. Our clients boot up their pcs in the morning or restart after windows updates…

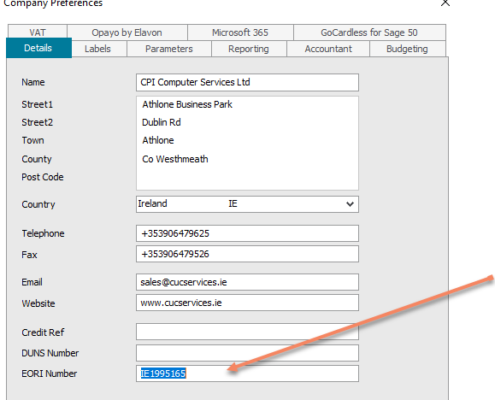

Post Brexit VAT – Get ready with Sage 50c Accounts

Sage 50c Accounts V27.1 and later versions are ready to deal with Post Brexit VAT. The latest version of Sage 50c caters for Postponed Vat and the…

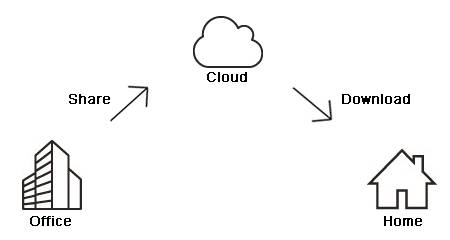

What is Sage Drive?

What is Sage Drive ?

Many clients ask "What is Sage Drive?" Designed to allow a user to work from home or a bookkeeper or accountant to access and work…

Bank Reconciliations

I reconciled my bank account last week. Now I see that my matched balance has changed – what has happened?

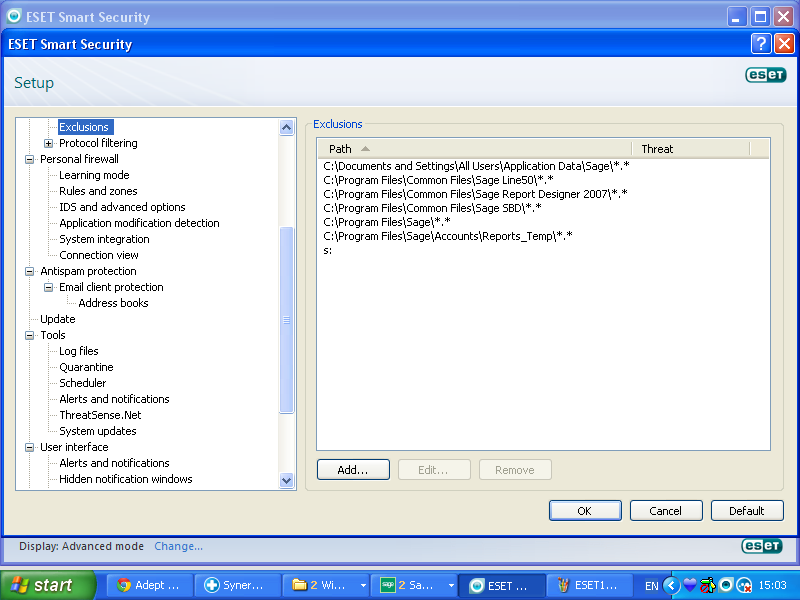

Configuring anti-virus software

How to configure your anti-virus software not to conflict with Sage.

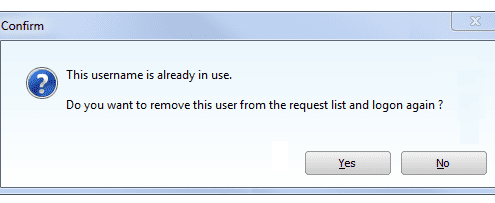

Logon Problems

How to remove the message: 'Username in use - the program cannot connect you at this time'.

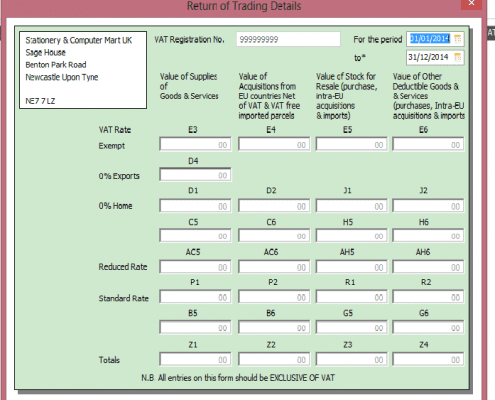

Return of Trading Details

In the Republic of Ireland, all VAT registered traders must submit an annual return of trading details on form RTD EUR. This return was introduced by the…

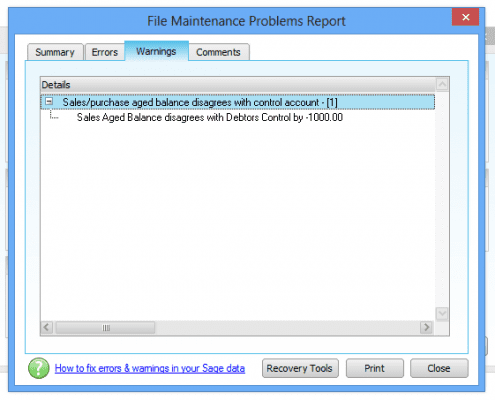

Debtors and Creditors Report

Reasons why the Debtors or Creditors Control Accounts do not agree with the aged debtors or creditors reports, and how to take corrective action

As part…

Sage 50 VAT Returns

First Step: Setting up your TAX CODES

By default they are set up for the UK Vat system so this is one of the first things we need to change in Sage 50…