Post Brexit VAT – Get ready with Sage 50c Accounts

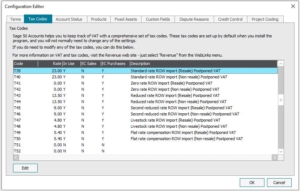

Sage 50c Accounts V27.1 and later versions are ready to deal with Post Brexit VAT. The latest version of Sage 50c caters for Postponed Vat and the changes in the Vat Return as a result of Brexit. Tax Codes are in Settings/Configuration Editor/Tax Codes where they can be checked or edited.

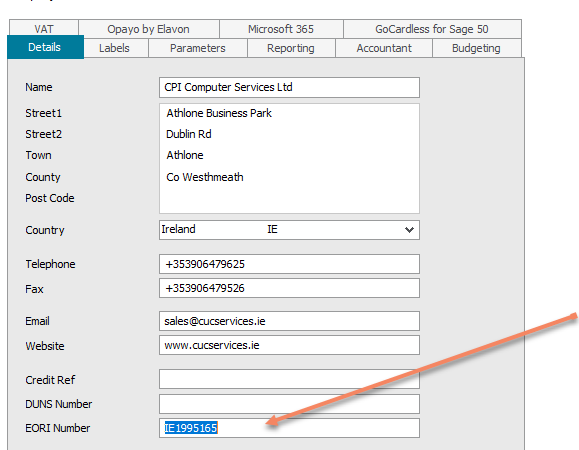

EORI Number

EORI stands for Economic Operators Registration and Identification. If you are a business who imports or exports goods into or out of the European Union, you will need an EORI number.

In Sage 50 this can be found in Settings/Company Preferences/Details

You can also add EORI numbers to your customers and suppliers.

Country Codes

A new country code has been officially issued for Northern Ireland which is “XI” and can be found in Settings/Countries.

Edit the United Kingdom code GB as it is no longer in the EU by unticking EU Member check box as follows:

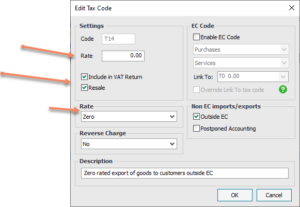

Export Sales Tax Codes

In Settings/Configuration Editor/Tax Codes

When selling goods to the UK you will now need to use a tax code that is ticked “Outside EC” as above. The Rate is zero.

PURCHASES UNDER BREXIT

Purchases from Great Britain and the Rest of the World will now be treated as imports using Postponed Vat Accounting.

Imports of Goods from Outside the EU

Postponed VAT Accounting

Postponed Vat Accounting came into play on the 1st of Jan 2020. It enables business to avoid cashflow issues with having to pay VAT at point of entry when importing from outside the EU.

Instead, Vat on these Purchases is to be shown under the inputs and to reverse also under the outputs.

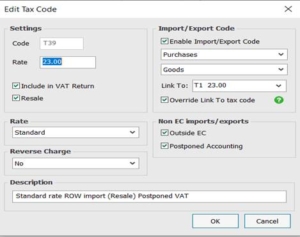

Sage 50 V27.1 has automatically set -up Tax Codes for Postponed VAT Accounting being for the import of goods, and we shall look at a few relevant codes.

Main codes are for Resale and Not for Resale at 23% Vat Rate. There are also Zero Rates and there are others for 13.5% and 9%.

Tax Codes

To note there is a rate entered (unlike for the export tax code) and new options:

- Outside EC

- Postponed Accounting

This will enter the VAT on input and automatically create a credit note against it.

Below is an example of entering a Supplier Invoice using a Postponed Vat Accounting VAT Code

The 23% Vat is entered but what you do not see is the credit note for the Vat which is produced when using T39.

When we look at the activity of the account where invoice was entered

The credit note was automatically entered and allocated at the time of the invoice so what is due is the 3,000.00 as above.

Outside EU Purchases – Other

Goods

If goods purchased outside the EU have VAT charged on them at the point of entry, it is advisable to use a dedicated tax code.

- Imports outside the EU for Resale

- Imports outside the EU not for resale

Of course, this depends on the Tax Codes you are using as they might already be set up in your system. These codes will have a zero rate as Vat at point of entry is usually entered in the Vat Box with the Net at zero as the invoice is already entered with zero vat using an import code.

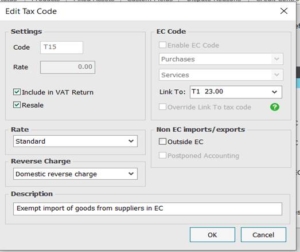

Services

Purchase of services from Northern Ireland and Britain and other non-Eu countries need to use self-accounting in these situations which means that if the vat in this country is 23%, you will need to insert that vat in Vat on Sales as well as Vat on purchases and they will cancel each other out.

The link is to 23% and reverse charge so that it will go in and out of the VAT Return.

VAT Return

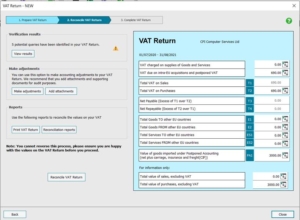

The Vat Return for JUL/AUG 2021 below with only ONE transaction being 3,000.00 invoice entered on the previous example

The title for the second box has changed to:

Vat due on intra-EU acquisitions and postponed VAT

This has the credit note for 690 and box T2 has the contra entry for 690 net difference is zero.

There is a box near the bottom of the return PA1:

Value of goods imported under Postponed Accounting.

This box holds the total value imported from non-EU countries using Postponed Vat Accounting.

In Summary

This article is just a summary of how to deal with Post Brexit VAT in your Sage accounting package.

If you would like to discuss your VAT requirements further with our team of experts, please contact

- sales@synergynet.ie or

- call Malcolm on (071) 9146815