Exciting Updates in Sage 50 Accounts v30.1

Exciting Updates in Sage 50 Accounts v30.1

Great news! The latest version of Sage 50 Accounts, v30.1, is now available. Here's a look at what's new and…

Discover What’s New in Sage 50 Cloud Accounts v30

Discover What's New in Sage 50 Cloud Accounts v30

The latest release of Sage 50 Cloud Accounts, version 30, is now available. This update brings numerous…

What’s New In Sage 50 Cloud Accounts v29?

What’s New In Sage 50 Cloud Accounts v29?

The Latest release of Sage 50 Cloud Accounts v29 is out now.

The aim behind the latest version is make…

Sage Payroll Year end 2022

Sage Payroll Year end Processing

(The end of Payroll TAX Year 2022)

Processing the Payroll Year end for 2022 (PYE) in Sage Payroll has never been…

Sage Critical Update Issue

IMPORTANT NOTICE BELOW REGARDING YOUR SAGE 50 ACCOUNTS SOFTWARE DO NOT IGNORE

In February this year, we advised you by email about a serious Critical…

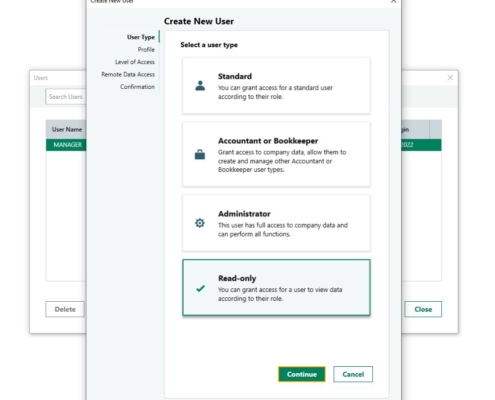

Sage v28.1 Read only user

You asked - they listened. Sage v28.1 now features a read only user.

In Settings->User Management-> Users you can now choose to create a read…

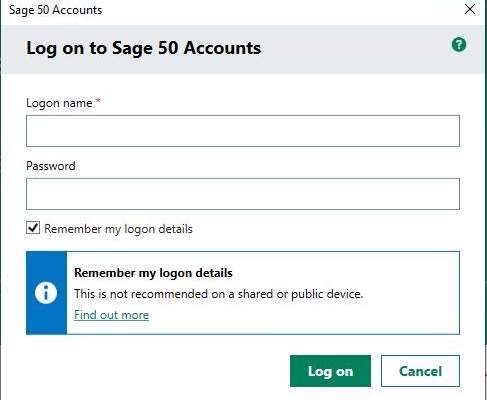

Sage v28.1 Remember login details

In the third blog of this series featuring the new features of Sage v28.1 we are looking at how to remember login details.

Do you tire of having to…

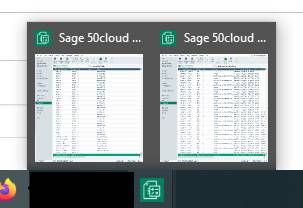

Sage v28.1 Open multiple companies

Do you run multiple companies in Sage? Have you ever wished that you could work in more that one company at a time, comparing reports etc?

Well now…

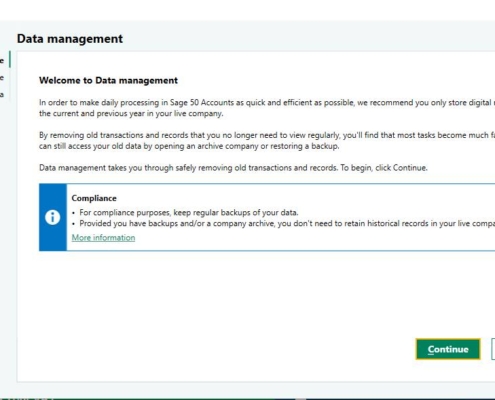

Sage v28.1 Data Management

Data Management

In this blog we are looking at one of the exciting new features of Sage v28.1, data management.

The functionality already exists in…

Sage 50 Accounts and Gmail

Many of our clients use Sage 50 accounts and Gmail. On May 30th 2022, Google change the way gmail works. For security reasons they removed the option "Allow…