Onion Reporting Software and Sage 50 Accounts

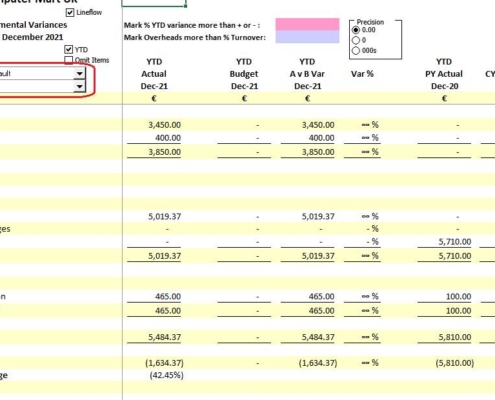

Struggling with Management Account Reporting?

Have you ever found that some of the reports needed for your management accounts are just not available…

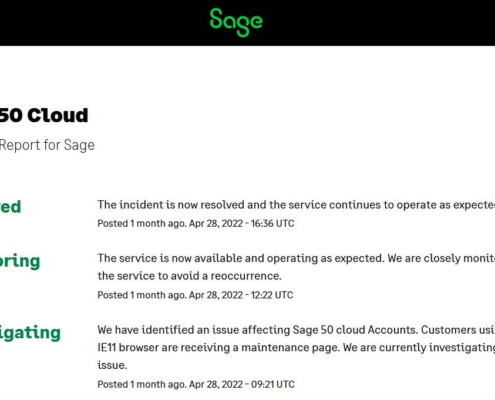

Sage Remote Access Down

What do you do if you think that Sage Remote Access is down or running really slowly? Our recommended first port of call is to check this website

https://status.sage.com/

Here…

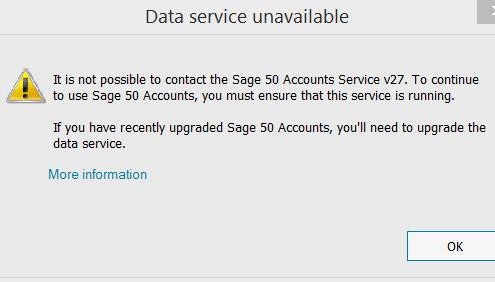

Sage Data Service

One of our most frequently asked questions is about the Sage Data service. Our clients boot up their pcs in the morning or restart after windows updates…

Sage 50 v28.1 Coming soon

Sage 50 Cloud Accounts v28.1

( New update Coming Soon….)

The next update of Sage 50 Cloud Accounts v28.1 is expected to be released shortly

Here…

Auto Enrolment Retirement Savings System

New Workplace Pension Scheme for Ireland - Minister Humphreys announces details of Automatic Enrolment Retirement Savings System

Ireland is the only…

AutoEntry in partnership with Synergy Network

For small business owners, the inputting of supplier invoices is a chore, can be subject to error and takes up valuable time. AutoEntry in partnership…

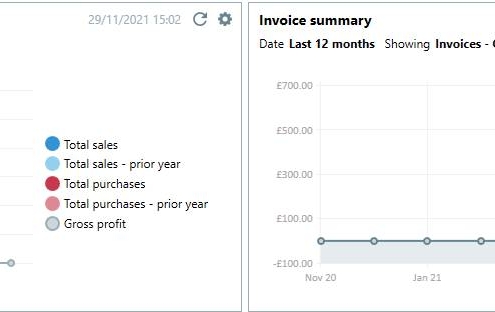

What’s new in Sage 50 v28?

Last month we told you that Sage 50 v28 had arrived. Now it's time to take a closer look at some of the great new features!

Sage Help Centre desktop icon

You…

Sage Payroll Year End

Sage Payroll Year end Processing

(The end of Payroll TAX Year 2021)

Processing the Payroll Year end for 2021 (PYE) in Sage Payroll has never been…

Multi company Direct Debit Solution

You spoke - we listened. We have updated our most popular Direct Debit software for Sage 50c. We are now offering a multi company Direct Debit solution.

The…

Sage 50 v28 has arrived – upgrade now!

The next release of Sage 50 Cloud Accounts v28 is available now

Here are some of the new features and improvements that have us excited...

Remote…