Import One Stop Shop (OSS/IOSS)

From the 1st July 2021 the Import One Stop Shop simplifies the reporting and paying of VAT when selling goods and services cross-border to final consumers in the EU (B2C).

A business that is signed up to use Import One Stop Shop can report and pay VAT on distance selling for all EU Countries in one go. The VAT rate used is that of the destination country and all can be paid quarterly through an Online Portal.

To Enable Import One Stop Shop/IOSS reporting, (Sage 50 v27.2 and upwards) go to Tools, and Click Tools then click Activation and click Enable OSS/IOSS reporting.

Select Nominal Code – 2205 OSS Union Tax Control Account

For each destination country a VAT rate needs to be setup for each rate:

In Settings, Configuration, Tax Codes.

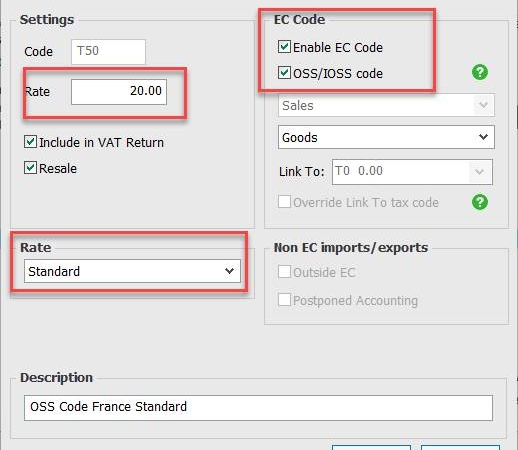

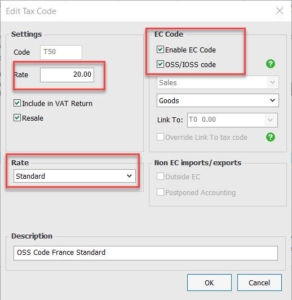

Setting up Vat Codes in Sage

Below is an example for the French Standard Vat Rate for 20% using T50 for Sale of Goods, there is a dropdown for services as well.

These codes are enabled for EU Purposes as they need to be recorded on VAT Returns as Goods and Services to EU Countries.

Entering Sales Invoices

A new option in entering sales is country of origin as below or when creating an Invoice.

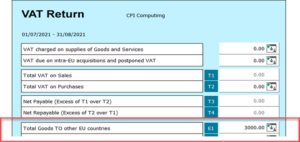

VAT Return

Value of sales for OSS inserted as well in E1 as above.

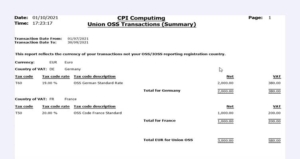

OSS Transaction Report

The summary report can be found in VAT, Reports, OSS/IOSS Transactions Folder.

An example of a 3 monthly report by country for entry to Online Portal:

Microsoft

Microsoft