VAT Treatment of Unpaid Purchase Invoices

VAT Treatment of Unpaid Purchase Invoices

In 2013 the government introduced a new VAT rule whereby “Businesses that do not pay their suppliers within 6 months will be required to repay the VAT previously claimed.” We blogged about it at the time but it has come to our attention again in recent weeks now that Revenue are requiring some businesses to adjust the VAT they claimed in 2014.

Where a person deducts VAT in a taxable period but has not within 6 months of the end of that taxable period, paid the supplier for the goods or services, an adjustment will be required in the VAT return. The amount of VAT deductible for the period will be reduced by the amount of the VAT relating to the unpaid consideration.

A re-adjustment is provided for in the event of subsequent payment or part payment for the goods or services.

This applies in respect of VAT reclaimed from 1st January 2014. You can make adjustments to the Vat Returns in Sage 50 to account for this.

How are we suggesting that our Sage support clients account for this?

There is a good report in Suppliers Reports under the Supplier Invoice section:

Outstanding Purchases Invoices over 6 months Old

Before running the report ensure all Purchase Credit Notes & Payments On Account are allocated.

The report will show the Vat for Creditors that needs to be clawed back. Contact support@synergynet.ie if you need extra information added to the report such as the VAT reconciliation date. We can also exclude non vatable (T9) invoices from the report.

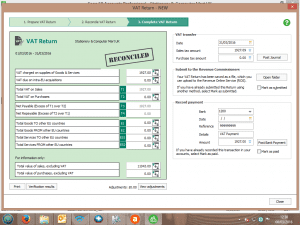

Tony advises that the adjustment to be entered is made through the Make Adjustment button on the Vat Return, updating the Nominal Code 2204 Manual Adjustments.

If the clawback has to be run again at a future date then run the above report at the required date reversing the original adjustment while creating a new Make Adjustment if required. This avoids the need to keep track of which Purchase Invoices have been paid since they will drop off the report.

Please note that if you know that an overdue Purchase Invoice will never be paid, you need to enter a credit note into Sage in order adjust the vat you have already claimed.

If you have a query on this new rule and how it applies to your Sage 50 accounting package, please contact James Doyle on (071) 9146815.