VAT Rate change 23% to 21%

VAT Rate Change to 21%

Under the Jobs stimulus package announced on 23rd July, the standard rate of VAT in Ireland will be reduced from 23% to 21%. This change will come into effect on Sept 1st and continue until Feb 28th 2021. The support team at Synergy Network is here to help you prepare your Sage 50 accounts package in advance for the VAT Rate change from 23% to 21%. Read on!

Recommended Tax Rate set up

We recommend that all clients set up two new Tax Codes in Sage 50

- 21% for Sales and Purchases for resale,

- 21% for Purchases Not For Resale.

For clients with older Sage 50 companies check first of all whether you have pre-existing 21% tax codes. You can mark these as “In Use” and follow the instructions below.

How to Create a new Tax Code

We recommend setting up

- T5: Sales and Purchases For resale

- T15: Purchases Not For Resale

If these codes are not available then use the next available Tax Codes, search for codes where the “In Use” Flag is ‘N’

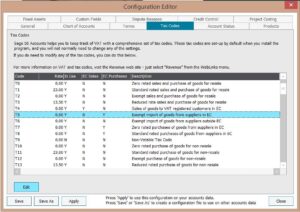

Select

- Settings

- Configuration Editor

- Tax Codes

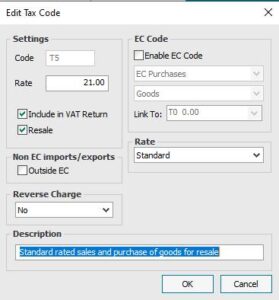

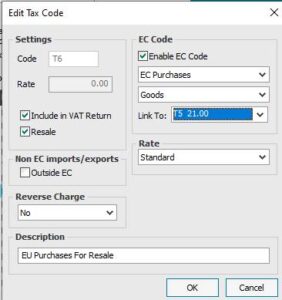

Select T5 for 21% Resale and edit as follows:

- Enter rate 21

- Ensure include in Vat Return Ticked

- Tick resale

- Select rate as Standard

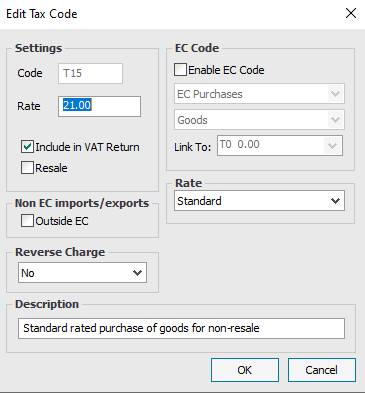

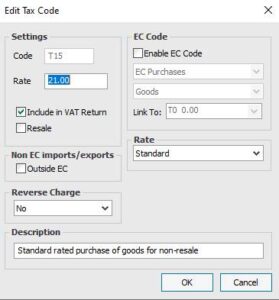

Select T15 21% Not For Resale Purchases and edit as follows:

This time Resale is not ticked.

EU Purchases Tax Codes

If available:

We recommend setting up

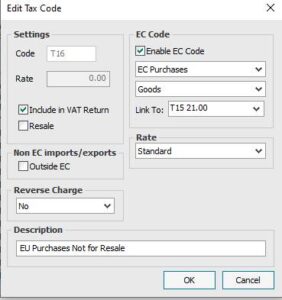

- T6: EU Purchases For resale

- T16: EU Purchases Not For Resale

- To keep changes, click OK

- Apply to keep changes in Configuration Editor if using Sage 50 Accounts while in Sage 50 Essentials use the Save option.

Outstanding Orders and Invoices

- Ensure that Invoices that include the Standard Rate of VAT at 23% with dates up to and including the 31st August are posted

- All Invoices with date from the 1st Sept should be updated with the new standard rate of 21% ie edit item lines to choose your new VAT rate(T5 or T15)

- For any Sales or Purchase Orders outstanding to 31st August inclusive that are updated from the 1st September ensure first that the standard tax codes are changed to the new 21% rate before posting.

Customer, Supplier and Product Records

Default Tax codes are held in the Customer, Supplier and Product records, if you need to change the tax codes for some or all of your records the approach will depend on the Sage version you have.

- If you are using Sage Essentials each record affected needs to be individually edited to change the tax code and saved

- In Sage 50 Accounts Standard and Professional, you can use the Batch changes option to amend a large number of records at the same time. Batch Changes option in Customer, Products and Suppliers module example below:

Other considerations

- If you use Add-On software to import transactions into Sage 50 Accounts, you may need to update the rules/settings in that software to include your new reduced VAT rate.

- If you have any recurring Invoices or Payments set up, check them all for standard rate of VAT. Edit to change the rate to 21%

And Finally…

We hope that you find this information useful. If you have any queries please contact our Support Team at (071) 9146815