Sage Payroll Year End

Sage Payroll Year end Processing

(The end of Payroll TAX Year 2021)

Processing the Payroll Year end for 2021 (PYE) in Sage Payroll has never been…

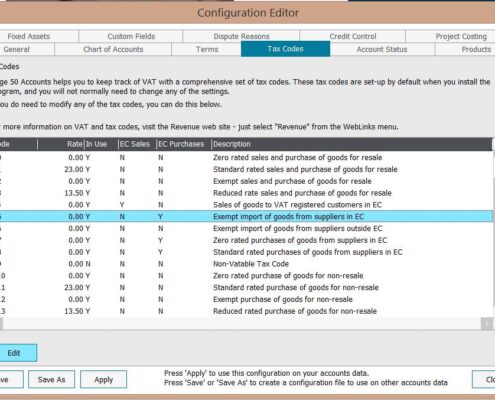

VAT Rate change 21% to 23%

VAT Rate Change to 23%

On March 1st 2021 the standard rate of VAT in Ireland will be increased from 21% to 23%. This will involve reverting back to the…

Payroll Year End 2019

Sage Payroll v23 takes the complexity out of payroll year end 2019 so you can have a stress-free close to 2019 and start 2020 with confidence.

You can…

Get Brexit Ready

Time to Get Brexit Ready

Tony recently attended an information session on steps that small businesses should take to prepare for Brexit. In conjunction…

Transition to SEPA for Ulster Bank customers

If you make Sage Supplier e-payments from an Ulster Bank account (using the Sage 50 ebanking facility) it's time to make the transition to SEPA (Single…

Sage 50 Data Corruption

We know how important the integrity of your Sage Accounts data is to you. Sage 50 data corruption is a serious risk to any business system and the resulting…

Direct Debit files from Sage 50 or any account system– SEPA Ready

With effect from 1st February 2014, the existing Irish electronic payment system will close down, following which all electronic Euro payments must be…

Vat Cash Receipts Basis – Budget 2013 Change

Accounting for Vat on a Cash Receipt Basis is a useful and positive Cash Flow mechanism for SMEs. Budget 2013 has increased the turnover threshold from …

Vat Cash Accounting and Foreign Trader

A while back we wrote an article on Switching to VAT Cash Accounting on Sage 50.

One of the issues that can prevent you from switching VAT systems is…

Hireman Pro VAT Rate Change

Hireman Pro Vat Rate Change for January 1st 2012

As you aware, in the recent budget, the standard rate of VAT will be increased from 21% to 23% from January…